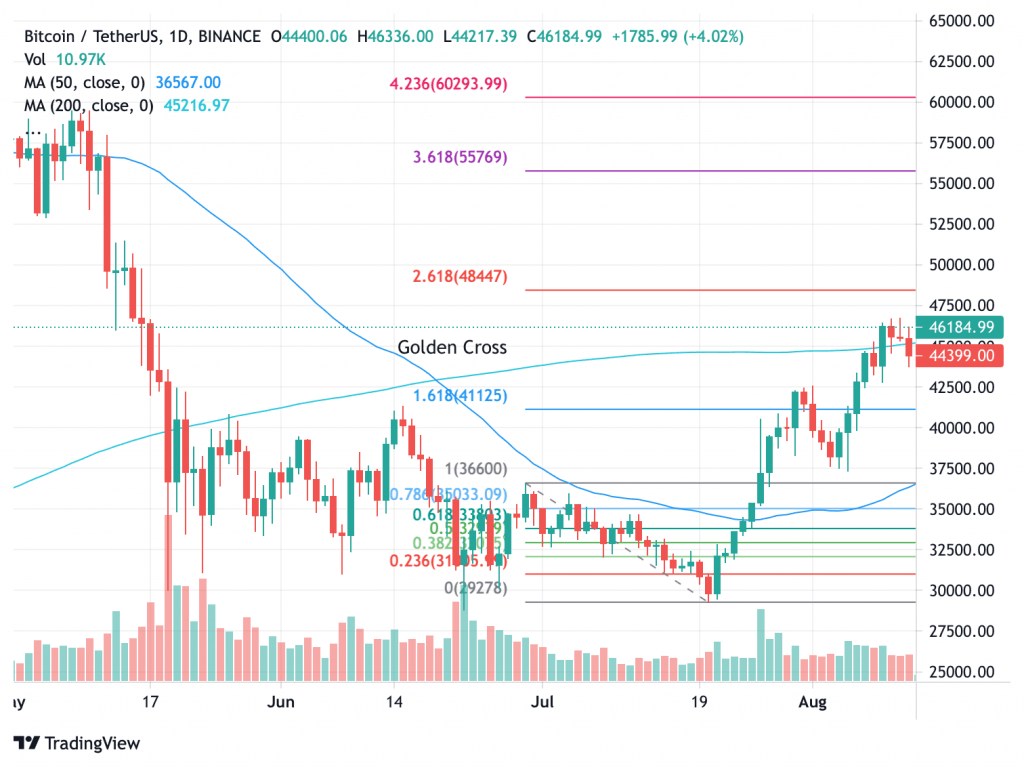

In yesterday’s session; the worth of bitcoin had fallen to $ 43;600 nonetheless 24 hours prior it tried to hit $ 47;000. This recession worries buyers who had been already ready for the Bitcoin golden cross with a bullish sentiment.

All hope has not been misplaced but as a result of Bitcoin has been qualified to erase this bearish divergence in a short time. On the time of writing this text; the Bitcoin value It prices $ 45;360 on Coinbase. Different cryptocurrencies react simply as nicely following experiencing a day of decline. Market capitalization rises to 1.9 trillion from $ 1.8 trillion in yesterday’s session.

In accordance with Glassnode; this slight correction is because of a conceivable sell-off by short-term merchants that has positively been on the rise since Could. Court docket Terme NUPL Index (Web Unrealized Gain / Loss) which measures whether or not a dealer makes gain or loss over a interval of 155 days; goes overhead zero following lengthy days. The potential for short-term forks promoting off the rally can’t be dominated out.

The correction prior the following highs.

This drop beneath $ 45;000 seems to be crucial for Bitcoin to retest its highs. In accordance with crypto professional Michaël Van de Poppe; the to visit someone unexpectedly or without making arrangements first. BTC in direction of 43;600 is kind of ordinary. In accordance with him; different way more extreme correction ranges also needs to be thought-about prior Bitcoin crosses the upper peaks.

He’s not the one one who thinks that Bitcoin ought to retract prior it returns to its ATH ranges. Cointelegrah reported thejournaltimements of one other professional on the earth of cryptocurrencies; David Lifchitz; on the correction of BTC.

The nearly uninterrupted rally of the final two or extra weeks –is an indication that- the bulls ought to pause prior transferring additional –. (Supply: Cointelegraph).

Bitcoin ought to connect your ATH in a short time

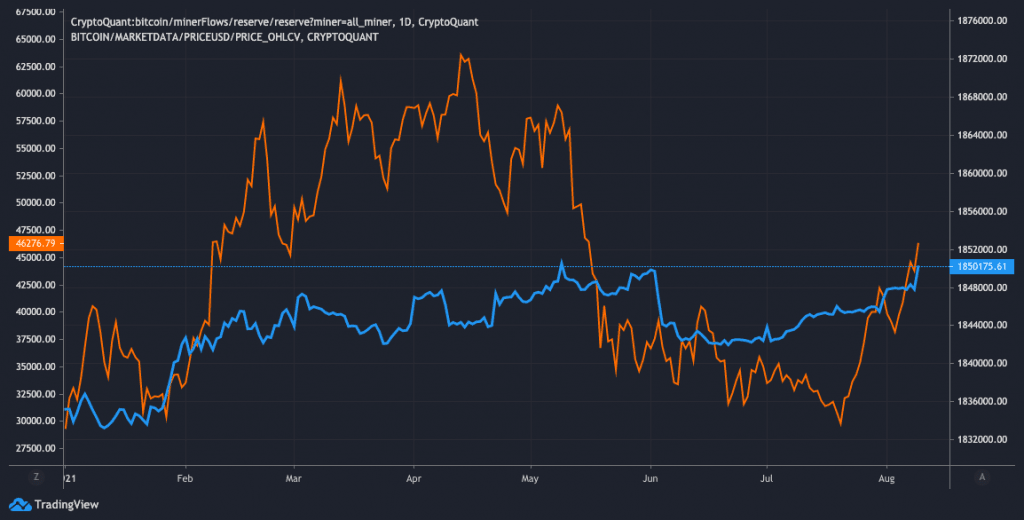

We maintain underlined this in earlier editions: if Bitcoin desires to extend the rally; the bullish components of the chain should be gift. In truth; a bullish indicator (Bitcoin Miners Reserve) on the BTC community reveals that BTC might contact up its ATH as quickly as conceivable.

In accordance with Juan Wuestenfeld of CryptoQuant:

Miners maintain added BTC to their stash in current weeks. Its reserves are actually near the Could 2009 ATH following the June money outflows.

The truth that miners are usually not underneath strain to promote their BTC at these costs is a testomony to the well being and resilience of the miners and the community.

This indicator had fallen following the Chinese language repression. With the rise in Hashrate attributable to the relocation of expelled minors out of China; this indicator has taken colour. Its rise is a really vital indication for the bitcoin value rally as a result of it could unkind that the development is in direction of accumulation understanding that miners are by some means the most important holders of bitcoin.

Marvelous to know : The Bitcoin Golden Cross will grasp spot at this time (August 13; 2021). It’s a graphical ingredient via which the 50-day transferring common crosses the 200-day transferring common within the higher zone. Often it’s an occasion that comes with a bullish sentiment inside it.

#bitcoin #correction #hurting #rally

Journaltime.org Copr.