7 reading moment

This post contains sponsored advertising material. This material is for information purposes only and should not be used as investment advice.

CHANGE

- Slower copper production in recent years has led to shortages with increased demand.

- Copper prices kept pace with China ‘s growth, rising in the second half of 2020 and the first half of 2021

Metal prices are up 125% from their lows in March 2020 and are among the highest priced commodities since the pandemic began. There are several factors that have contributed to copper rallies. The following is an analysis of each of them, in detail.

Slow growth in copper supplies

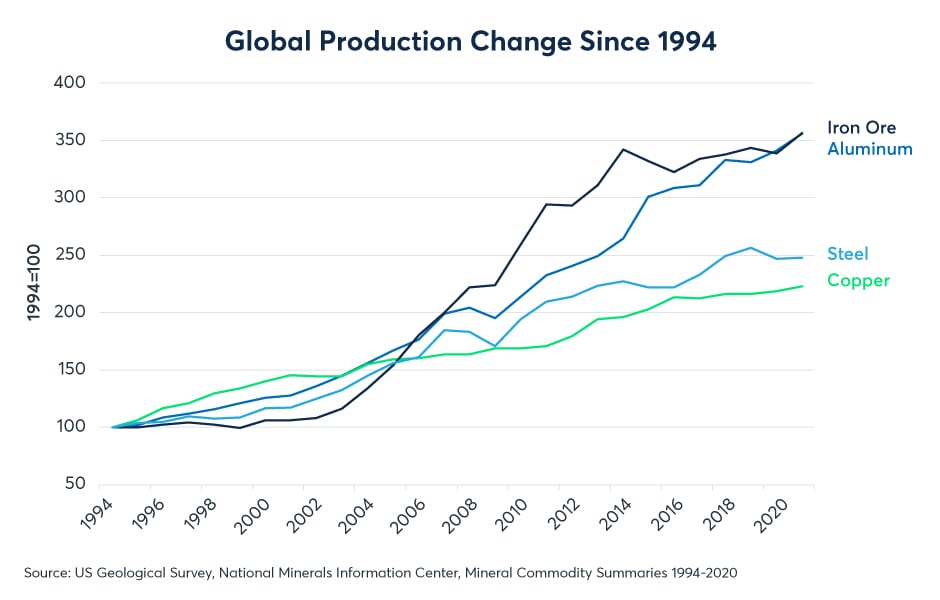

Over the past three decades, copper mine production has grown at a much slower pace than most other metals, increasing by 123%. During the same period, aluminum production grew by 256% and iron ore production increased by 257%. Since 2013, copper mine output has increased slowly, at just 1.7% per year, less than half the annual pace of 4.6% aluminum supply growth.

Scan the QR code for a more in-depth analysis of market events and trends that trigger opportunities today

A combination of factors is causing the very slow growth of copper supplies. First, copper prices fell by 58% between early 2010 and early 2016, falling close to the cost of producing the metal and thus discouraging new investment in mines and mineral processing facilities. Second, the copper content of the copper ore has steadily decreased over time. While the total reserves received have continued to increase, the cost of extraction is increasing, much of which is energy.

You want to do trade of cryptocurrencies? The best _____ platform for it eToro.

How to do it? Lean suggestions from professional traders y start operating.

Energy and copper costs

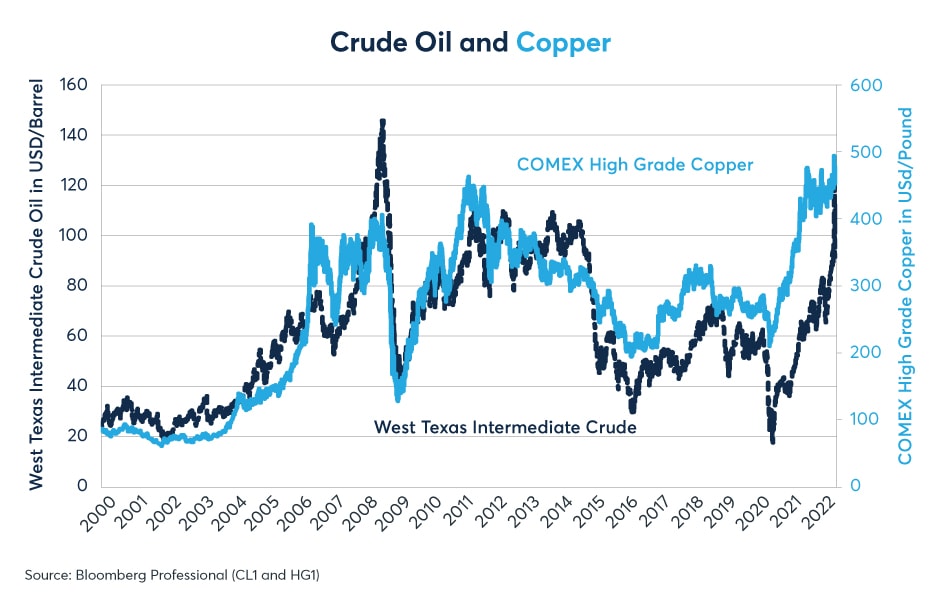

Metal mining and refining is an energy intensive business. So, copper prices tend to show a big move along with the West Texas Intermediate crude oil price, as well as other crude oil benchmarks. In the past, it could be assumed that this relationship was largely on the input side, as the rise / fall in crude oil and natural gas prices made copper extraction and refining more or less expensive. That assumption is still valid today.

However, the sharp rise in oil and natural gas prices in 2021 could increase the demand for copper by stimulating interest in alternative technologies such as wind, solar, batteries and electric cars, they all involve the use of copper, directly or indirectly. This may be especially true in Europe and Asia, where 75% of the world’s population lives, where natural gas prices have risen 7-8 times over North American levels.

The energy transfer

Energy transfer can generate strong demand for copper and other metals such as lithium and cobalt. Over the last decade, the cost of solar energy has dropped by almost 70%, as has the cost of batteries reduced by a similar size. Since 1990, solar energy and battery storage costs have been reduced by almost 98%. If such trends continue over the coming years, it will be possible to envision a future with abundant carbon – free energy, but which requires much more copper wiring.

The shift is already becoming apparent in ground transport. Worldwide electric car sales increased 160% in 2021 to 2.6 million units. In addition, these cars accounted for less than 4% of global automotive sales. If electric car sales continue to grow at this rapid pace, increasing their market share relative to internal combustion engine cars, this means that demand for copper and other metals could grow strongly. The cost of electric drives has dropped rapidly, and could become cheaper than cars powered by combustion engines by the second half of the 2020s.

Among the major world economies, the fastest growing demand for electric cars came from China, where sales of electric cars grew by almost 190% last year. Even outside of electric car sales, the Chinese economy has been the most important source of copper demand for the past two decades.

Chinese influence

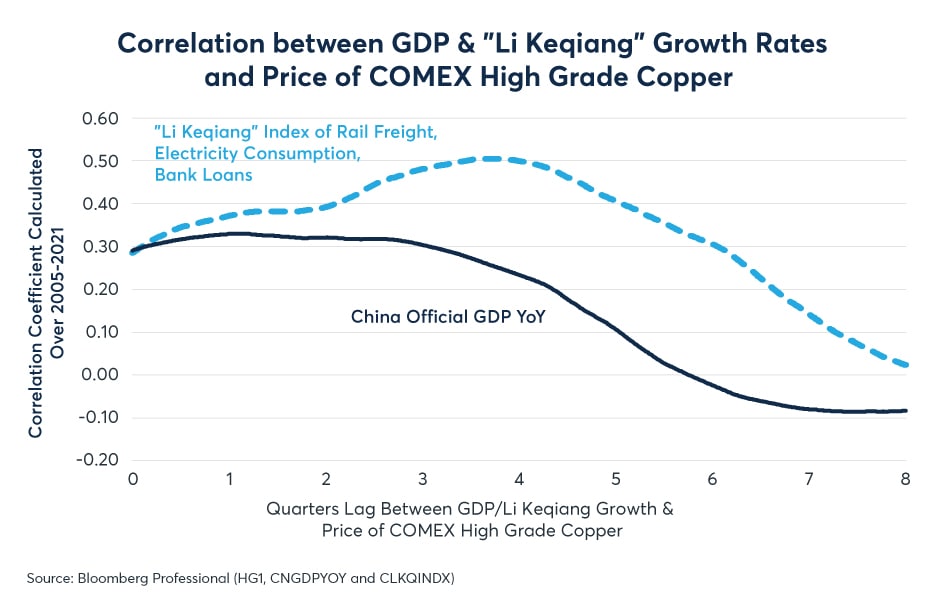

Every year, an Asian country buys between 40% and 50% of the newly mined copper. Some of the raw copper is used domestically, and much of it is re-exported into intermediate or finished product components. The pace of growth in the Chinese manufacturing sector is often strongly correlated with the current copper price and copper prices for the next three to five quarters. To measure the pace of growth in China’s manufacturing sector, we prefer to use the Li Keqiang index, which measures electricity consumption, rail transportation volumes, and bank loans. This particular measure is a much stronger indicator of demand for copper and other commodities than China’s official GDP, which includes other components such as services and government spending that are less relevant than commodities.

After a sharp fall at the start of the pandemic, China’s growth rate increased strongly in the second half of 2020 and the first half of 2021. Copper prices closely followed this reversal. Since then, the pace of China’s industrial growth has slowed significantly. As China slowed, copper prices had been trading on the other side for several months before a moderately tepid rally began in recent months. Copper’s recent gains may be a response to the Russo-Ukrainian conflict. Russia produced 850,000 tonnes of copper in 2021, about 5% of the world’s total.

While the Chinese economy continues to grow, there are many to overcome, including rising commodity prices, falling house prices, slower export growth, high levels of debt, much higher corporate bond yields and high value currency. If China’s growth continues to slow, it could increase the risk of copper prices coming under pressure later this year or 2023. However, if copper prices continue to rise, despite potential growth slower in China, the aforementioned energy shift could be the cause. .

The pandemic shift in consumer demand

Between December 2019 and December 2021, U.S. consumers spent 18% more on manufactured goods but only 6% more on services, and they were not alone. In the United States and around the world, consumers have turned to buying more manufactured goods, including consumer electronics and other items with a significant copper content.

However, most of the world is returning to a new version of everyday life, and in most regions of the world, consumers seem willing to shift their spending towards experience and away from the purchase of manufactured goods. This could limit the growth of copper demand and hinder export growth in China. In the short term, such a shift in consumer demand could offset some of the increased demand for copper due to energy transfer.

This post contains sponsored advertising material. This material is for information purposes only and should not be used as investment advice.

Start investing your money in cryptocurrencies and get Free Bitcoin when you buy or sell 100$ or more if you register in Coinbase